Are you a landlord or property manager tired of dealing with late payments? Are manual calculations of late fees taking up too much of your valuable time? As a landlord, rent payments are the lifeblood of your business. When tenants pay late, it can cause serious financial strain on your bottom line and can cause a domino effect on your financial planning, especially when it comes to budgeting and paying bills. While it’s important to be flexible and understanding in certain situations, it’s also essential to have a policy in place for rent late fees.

In this article, we'll discuss what a late rent fee is, things you need to know about late rent fees, how to calculate it, and how an online software My e-Property Manager can help automate the process for you. Before we begin, it's important to note that late fee laws vary by state, so make sure you check your local laws and regulations.

Late Rent Fee Calculator

Great, you calculated the late fee amount! What is even better is that this late fee calculator is already embedded in the invoice generator tool for quick and easy invoice generation. Create a professional looking invoice in minutes for free!

What is a Late Rent Fee?

A late rent fee is a penalty charged to a tenant who fails to pay rent by the due date specified in the lease agreement. This fee acts as an incentive for tenants to pay their rent on time and covers the landlord's expenses related to the late payment.

5 Things You Need to Know About Rent Late Fees

Here are 5 things you need to know about rent late fees:

1. They are legal

It’s important to note that rent late fees are legal and enforceable in most states. As a landlord, you have the right to set a late fee in your lease agreement and collect it from tenants who fail to pay rent on time.2. They incentivize on-time payments

Rent late fees incentivize tenants to pay on time. When tenants know that there is a financial penalty for paying late, they are more likely to prioritize their rent payment and avoid being charged additional fees.3. They should be reasonable

While it’s legal to charge rent late fees, it’s also important to make sure that they are reasonable. A late fee that is too high can be seen as punitive and may be difficult to enforce. A reasonable late fee is typically around 5% of the monthly rent payment.4. They should be clearly outlined in the lease agreement

To avoid any confusion or misunderstandings, it’s essential to clearly outline the late fee policy in the lease agreement. The policy should include the amount of the late fee, the grace period for late payments, and any other relevant information.5. They should be enforced consistently

Consistency is key when it comes to enforcing rent late fees. If you waive the late fee for one tenant, it sets a precedent that can be difficult to reverse. Make sure to enforce the policy consistently for all tenants to avoid any potential legal issues.How to Calculate Late Rent Fees?

The late rent fee is usually a fixed percentage of the outstanding balance, a flat fee or a combination of both. A fixed late fee is a predetermined and unchanging amount of money that the tenant is required to pay if they do not pay their rent on time. The fixed fee can be a set dollar amount or a percentage of the outstanding balance, and it remains the same regardless of how long the rent is past due. Fixed fees are a straightforward and easy-to-understand way to charge late rent fees and can provide a clear incentive for tenants to pay their rent on time.

If the late fee is a flat fee, such as $50 for a monthly rent of $1000, then the late fee would be calculated as follows:

Late fee = $50 when rent is not received with in a certain duration after its due.

In most cases, rent is due on 1st of the month and landlords give up till 5th to pay without a late fee.

The percentage method, on the other hand, calculates the late fee as a percentage of the outstanding balance. It involves a simple formula:

Late fee = Outstanding balance x (Late fee percentage/100).

For example, if the outstanding balance is $1000 and the late fee percentage is 5%, the late fee would be calculated as follows:

Late fee = $1000 x 0.05 = $50

It's important to note that some states have laws that limit the amount of late fees that landlords can charge. For example, in California, late fees cannot exceed 5% of the monthly rent or $50, whichever is less.

Using a combination of a fixed amount and a percentage can provide flexibility in late fee calculation, as it allows for a minimum late fee amount to be set while also taking into account a percentage of the outstanding balance. This method can also incentivize tenants to pay on time, as the late fee increases with the amount of balance that is overdue.

Let's say the fixed late fee is $50, and the percentage late fee is 5%. The monthly rent is $1,000, and the tenant is 10 days late in paying.

First, we calculate the percentage late fee by multiplying the monthly rent by the percentage:

$1,000 x 0.05 = $50

Then, we add the fixed late fee to the percentage late fee:

$50 + $50 = $100

So the total late fee for this month is $100.

If the tenant is 10 days late in paying, and the outstanding balance is $2,500, we can calculate the late fee as follows:

First, we calculate the percentage late fee based on the outstanding balance:

$2,500 x 0.05 = $125

Then, we add the fixed late fee to the percentage late fee:

$50 + $125 = $175

So the total late fee for this month is $175.

As you can see from these examples, calculating late fees is relatively straightforward. However, it's important to remember that late fees are meant to incentivize tenants to pay their rent on time and not to generate income for the landlord. Therefore, it's important to use late fees judiciously and in accordance with local laws and regulations.

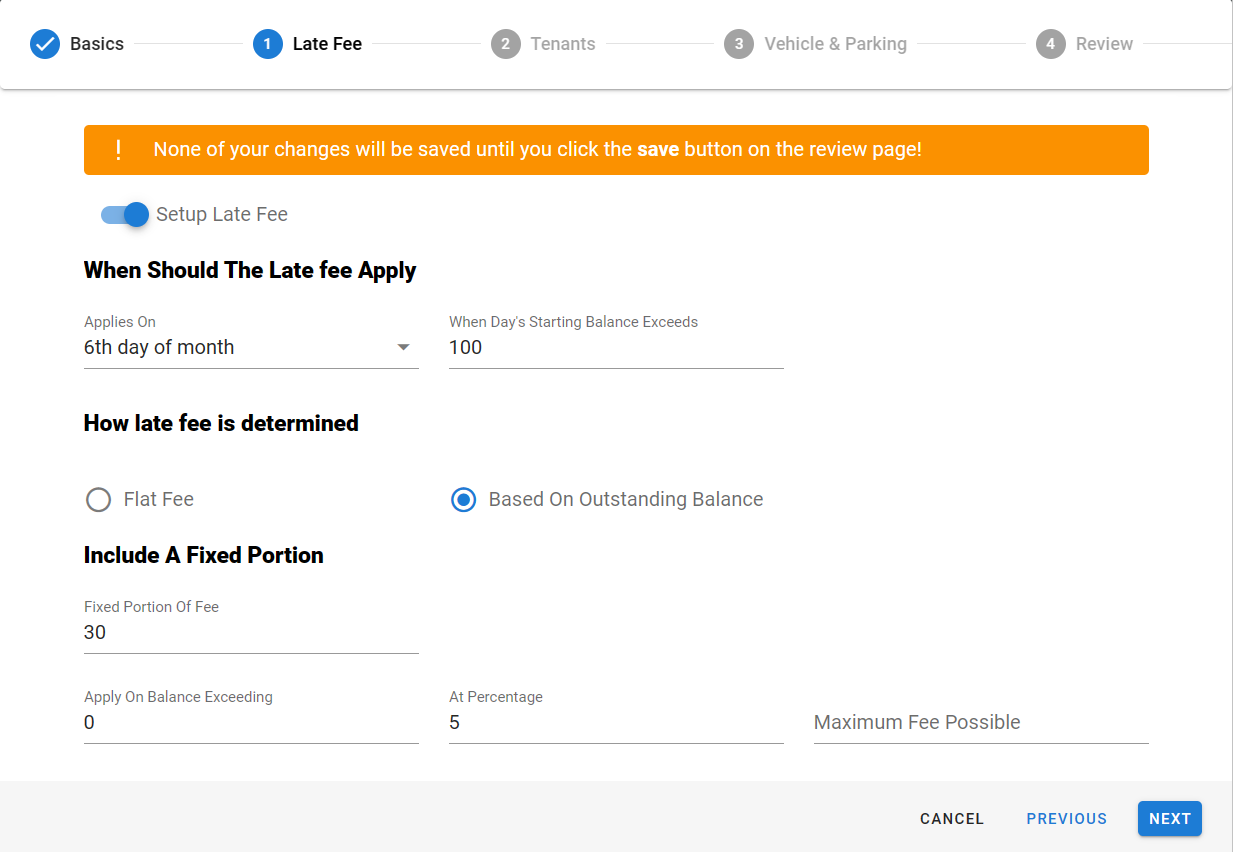

Letting My e-Property Manager do the late fee calculations for you

With My e-Property Manager, late fee calculation is made even easier as the platform allows landlords and property managers to set up late fee calculations in the lease agreement. The late fee can be based on a fixed amount, a percentage of the outstanding balance, or a combination of the two, and will be automatically reflected in the invoices. This feature ensures accurate and consistent late fee calculation, and saves time and effort in manual calculations. This way, you can rest assured that you are charging the correct amount for any late payments, and there's no need to double-check the math.

The late fee calculation in My e-Property Manager is flexible and customizable, allowing you to set up a fixed portion of the fee or a percentage of the outstanding balance. You can also set a minimum threshold for the outstanding balance at which the fee applies and a date when it comes into effect. This way, you can create a tailored late fee policy that works best for your rental business.

Another great feature of My e-Property Manager is the ability to omit the late fee for small outstanding balances. You can set the late fee calculation to only apply to balances exceeding a certain amount. This way, you can avoid charging unnecessary late fees and maintain positive relationships with your tenants.

Finally, you can set the day of the month for when the late fee should apply. This way, you can ensure that your tenants are aware of the due date for rent and that late payments are compensated appropriately.

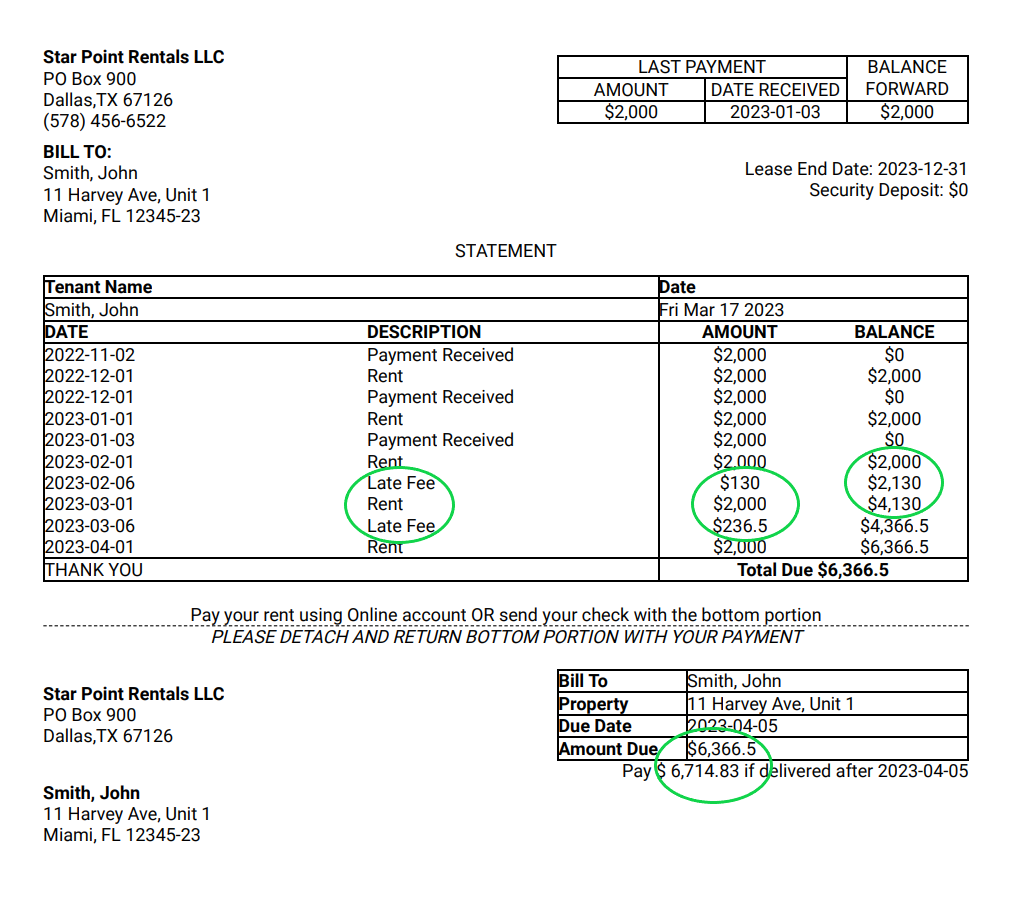

(Example of invoice showing late fee set up in the lease as shown above)

In conclusion, understanding how to calculate late fees is an important aspect of property management. It's important to have a clear understanding of local laws and regulations and to use late fees judiciously to ensure timely rent payments. By using the simple formula of late fee percentage, landlords and property managers can accurately calculate late fees and avoid any potential cash flow disruptions. By setting a reasonable policy, clearly outlining it in the lease agreement, and enforcing it consistently, landlords can avoid financial strain and maintain a healthy business.

My e-Property Manager is an essential tool for landlords and property managers who want to manage their rental business efficiently. With its automatic late fee calculation feature, you can save time, ensure accuracy, and maintain positive relationships with your tenants. So why not give it a try and see the difference it can make for your rental business?